COVID-19 Update 2

The Australian Government announced the second stage of its economic plan to cushion the economic impact of the coronavirus and help build a bridge to recovery.

As your local member, I am here to help you access assistance that is available during this challenging time. If you have any questions or queries regarding these announcements, contact us immediately using one of the methods above or register your mobile number for a call back from one of our friendly electorate staff.

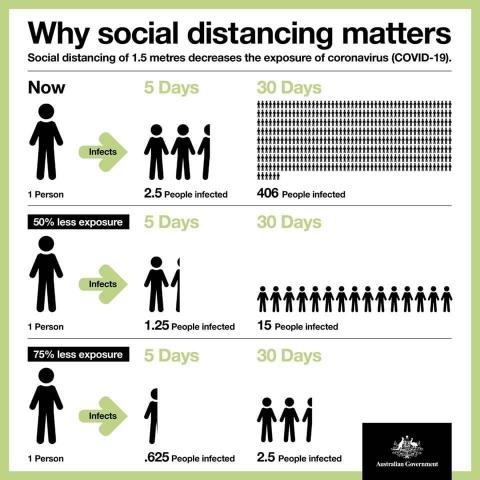

The Government has also reiterated the importance of social distancing. From 12:00pm 23 March 2020, some facilities are now restricted from opening including, pubs, gyms and cinemas. Restaurants and cafes will be restricted to takeaway and home delivery. This is Stage One. Remember, don’t shake hands or exchange physical greetings. Wherever possible stay 1.5 metres apart and practise good hand hygiene, especially after being in public places.

While these are challenging times, our Mitchell community can rest assured that the Australian Government will do all that is necessary to support them.

Together we will get through this.

Support for Workers and Households

Coronavirus supplement

The Government is temporarily expanding eligibility to income support payments and establishing a new, time-limited Coronavirus supplement to be paid at a rate of $550 per fortnight for the next 6 months.

Eligible income support recipients will receive the full amount of the $550 Coronavirus supplement on top of their payment each fortnight.

Payments to support households

In addition to the $750 stimulus payment announced on 12 March 2020, the Government will provide a further $750 payment to social security and veteran income support recipients and eligible concession card holders, except for those who are receiving an income support payment that is eligible to receive the Coronavirus supplement.

Early release of superannuation

The Government will allow individuals in financial stress as a result of the Coronavirus to access their superannuation. Eligible individuals will be able to apply online through myGov for access of up to $10,000 of their superannuation before 1 July 2020 and a further $10,000 from 1 July 2020 for another three months. They will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments.

Temporarily reduce superannuation minimum drawdown rates

The Government is temporarily reducing superannuation minimum drawdown requirements for account based pensions and similar products by 50 per cent for 2019-20 and 2020-21. This measure will benefit retirees by providing them with more flexibility as to how they manage their superannuation assets.

Reducing social security deeming rates

The Government is reducing the deeming rates by a further 0.25 percentage points to reflect the latest rate reductions by the RBA. As of 1 May 2020, the lower deeming rate will be 0.25 per cent and the upper deeming rate will be 2.25 per cent.

Support to Businesses

Boosting Cash Flow for Employers

The Government is providing up to $100,000 to eligible small and medium sized businesses, and not‑for-profits (including charities) that employ people, with a minimum payment of $20,000. These payments will help businesses’ and not-for-profits’ cash flow so they can keep operating, pay their rent, electricity and other bills and retain staff. The payment will be available from 28 April 2020.

Coronavirus SME Guarantee Scheme

The Government will establish the Coronavirus SME Guarantee Scheme which will support small and medium enterprises (SMEs) to get access to working capital to help them get them through the impact of the coronavirus.

Under the Scheme, the Government will guarantee 50 per cent of new loans issued by eligible lenders to SMEs.

Providing temporary relief for financially distressed businesses

The Government is temporarily increasing the threshold at which creditors can issue a statutory demand on a company and the time companies have to respond to statutory demands they receive. The package also includes temporary relief for directors from any personal liability for trading while insolvent.

Businesses can call the dedicated Business Help Line on 13 28 46 from 7:00am to 11:00pm 7 days a week for specialised business advice on getting COVID-19 support.